Neptoon.dk is owned 100% by Danish domiciled entity Neptoon ApS. Despite its danish URL it’s an international platform for private asset management. Or private digital asset management supported by professionals. Neptoon ApS is not monitored by the local FSA authorities amid our objectively and model driven solutions framwork.

Neptoon does NOT manage peoples money, so we don’t receive a cent from investors, except for a small monthly invoiced fee for access to the platform and its vast amount of solutions and professional insight. Neptoon is a membership-based and financed product allowing Users or members to take advantage of the software. It is a SaaS product. Investors money and portfolio stay where its is already. So investor also keeps her current custody and trading solutions in the bank, mobile or online as on Saxo Bank or Nordnet Bank in the Nordics.

No. Neptoon is a digital and membership-financed solution that solves private investor’s biggest challenge in understanding and managing their current and future portfolio wealth and future cashflows. Either in (savings) or out (dissavings, retirement) of the initial portfolio wealth. Essentially making Neptoon a lifecycle savings-consumption vehicle. Neptoon.dk hosts the financial engine “Neptoon Solutions” which is an advanced successor to “Ubanking Solutions”. Like other products in the Neptoon ApS family, Neptoon.dk is a digital platform addressing and facilitating financial investments for private investors. So, Neptoon.dk is a forward-looking tool and not a database of your current investments. Investor’s portfolio always sits in his og her own custody and bank.

Neptoon solves the primary challenge for private investor’s management of wealth. For most private investors, perhaps 98%, it is hard to avoid assistance from expensive local bank advice. This construction, or institution, is despite fierce criticism from academia throughout decades, still more than alive. The problem of course is that banks charge enormously high fees, and even worse has so large conflict of interest that they offer even very bad product to clients as long as it offers the highest fees to banks. On top of this, the invoice structure is not transparent as money fess are transferred from a bank account that is linked to the “Investment Funds” and not to investor. Particularly worrying is the invoice structure on socalled Private Banking arrangements, where another layer of costs are added and also often a very complex return-dependent extra cost. Normally banks charge around 2-2,5% p.a. and even more for Private Banking.

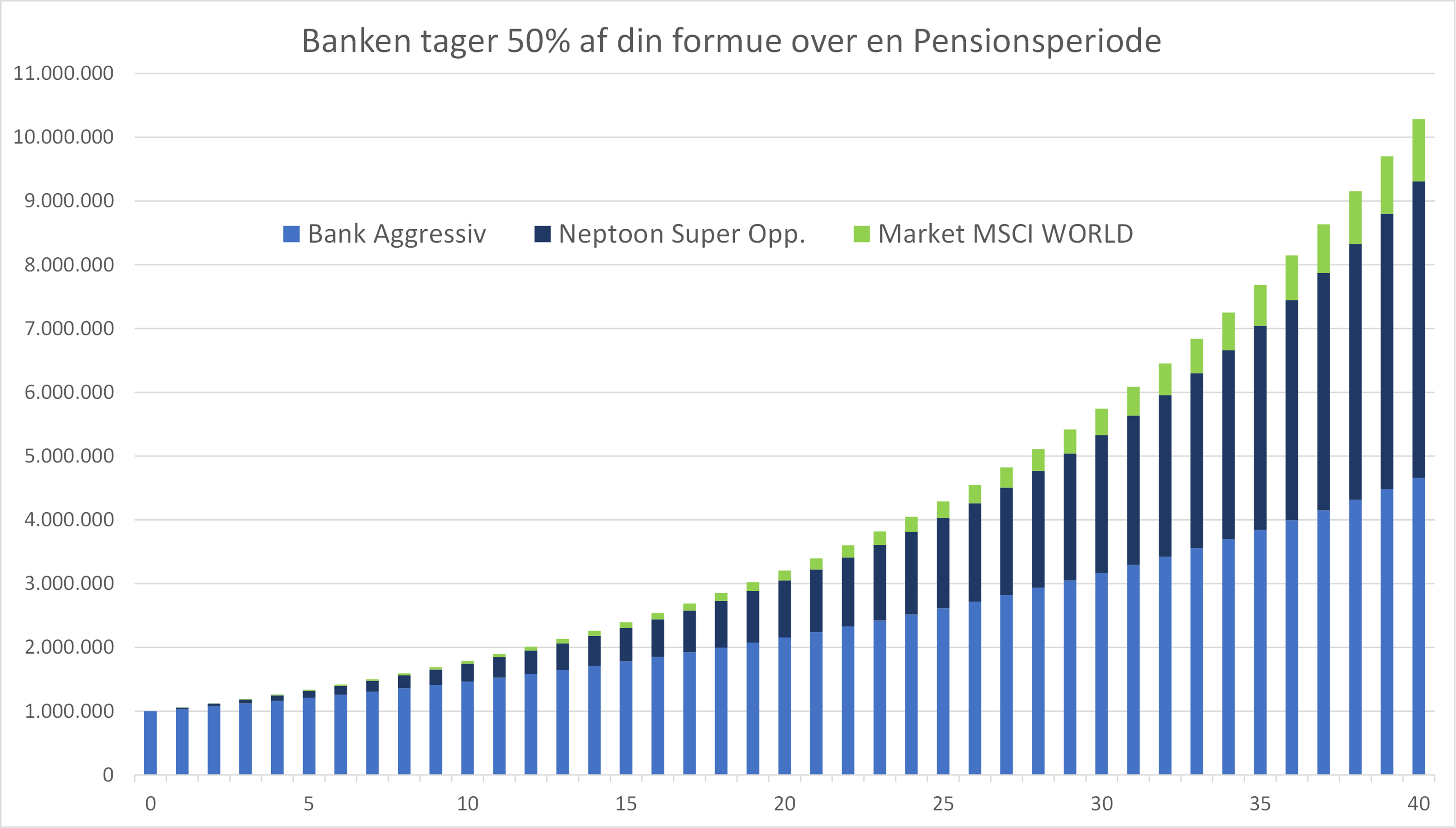

Do investors know the accumulating impact over time of there heavy cost-related return reductions? No, it is shown year by year and as such the accumulated effect is hidden. Purposely. But even IF investors knew that a 2,5% TER cost would shave of 50% of the total EUR wealth in 30 years, they would probably still accept the advice. Why? Because most investors are uncomfortable in maneuvering around the financial landscape. With lack of interest, afraid of making mistakes and perhaps even a funny believe in the crystalball foresight of the bank adviser, investor willingly accepts the arrangement.

Neptoon.dk is built to solve exactly these fundamental challenges and irrationalities by offering a conflict of interest-free platform with a fully guided path to the optimal portfolio. Followed by regular notifications with suggested changes. No transfer of money to Neptoon.dk. Maximum risk on Neptoon is one month of membership, max EUR10-12. Investor can at any time unsubscribe with effect immediately.

Like for professional asset managers in banks, portfolio history and current construction, is only to a little extent critical for the forward-looking new portfolio. At any time investors current view of future financial developments are governing the portfolio. Not history. In some cases taxes and trading costs can obstruct this “forward-loooking only” approach. In the system however trading costs are assumed to be 0%, and effective taxes are symmetric. You can not speculate in tax dynamics.

Consider Neptoon.dk as a platform on top of your current portfolio/custody that 1) guides the optimal path towards highest risk adjusted return at lowest costs and 2) Provides you with tools to evaluate what risk to take and where to take it. Including selection of mutual funds, index funds and ETF’s.

You can however analyse your current portfolio in Neptoon, but as suggested above It will not affect the optimal new solution.

The Neptoon core modelling framework is technical as it is founded on models in statistics, mathematics and economics. However, most complicated is the User accessibility and flexibility optionality. Building this requires not only PhD technical involvement, but also very experienced professional people from financial markets. Neptoon is built using various consultants, albeit driven by MSc in Economics and Finance, author and CEO Thomas Peter Clausen.

The User-simple and User-driven investment and portfolio flow with professionally guided assistance from a robot. Neptoon essentially offers portfolio management software, yet with a professional algorithm to support User in decision making. Bank’s have this advantage versus private investors, that they have the tools and setup to produce credible, albeit expensive, solutions to clients. With Neptoon.dk investor gets her own easy-to system to come up with a desired solution. At no costs User can retrieve 4 professional ETF solutions that match User’s risk appetite. With the paid version User can navigate in a large section of various funds from both the ETF universe and Mutual Fund universe. All screened to User’s country origin.

In order to capture the almost 30% of expected equity returns banks get, investors need a set of transparent, easily understood and manageable tools. Tools, today only in the hands of professional bankers. Ultimately, Neptoon reduces the difference between professional and private investors to a point, where practically only luck matters for who is the best. E.g. guessing on tomorrows market return. Below is a diagram showing on a 4o year Pension horizont the brutal bank cut of potential investor wealth. The upper green wealth is the clean market return of 6% p.a. The Neptoon return is 6% reduced by 0,25% p.a. for both ETF costs and Neptoon platform costs. Last the banks with 2% TER.

Because banks have no commercial interest in making public their investment tools. Not to mention a product universe where investors can choose among cheapest products.

Because it can only be implemented with a high-level mix of know-how, technology and financial products.