By Thomas Peter Clausen, 19-02-2021

Neptoon ApS offers world’s first Elite Digital Asset Management platform targeted global retail investment clients. See also our media intro here.

Clients can enter as free with access via country/location gates to client and country tailored portfolios. With free access many standard analytical tool can be applied in the predefined standardized investment setup with 4 risk/return solutions for each clients country. Spanning from low to high risk.

However by upgrading, clients can personalize further his or her view on markets as well as include recurrent cashflows in or out of portfolio, leverage or single stocks.

The interactive platform, the dashboard, is a key feature of the product. However underneath all variables are updated to market expectations. Also all country portfolios have a cyclical and structural profile that is managed by professionals. When Clients sign up for Upgrade they receive information when Neptoon has changed its model portfolios.

Clients do not transfer ANY wealth – any portfolio

No transfer of your money or portfolio. No risk on us. Simply just evaluate results and if desired, download, E-mail or print your own short-term or long-term ETF profile, and then trade on your own account. At any time our platform can be used as market updated guidance.

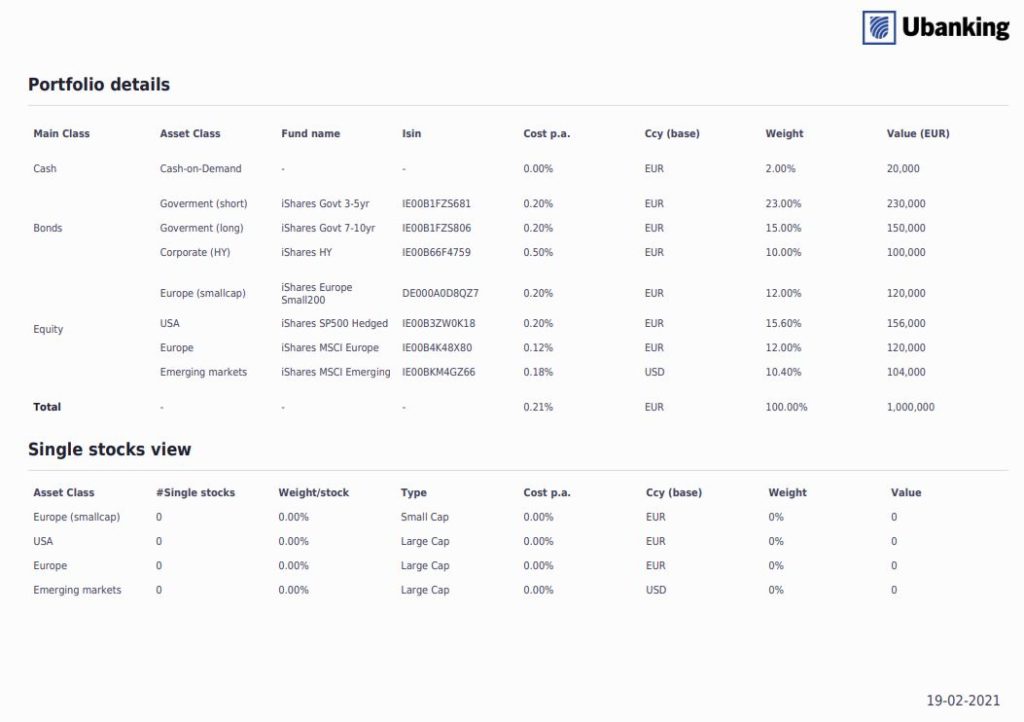

Example on report on EUR Clients with 50%/50% ETF portfolio

Two approaches to fast and professional output

A simple approach, and a less simple approach for investors to build fast, intuitively and credibly, a wealth plan (portfolio), that captures highest return (and lowest costs) for lowest risk possible risk in the global financial markets.

How Neptoon solves Private Investor objectives

Ubanking.dk is a simple and intuitive investor platform, yet extremely complex and professional underneath. The complex universe below (the platform), not only stems from the mathematical and financial calculations, but also functionalities to dynamically give User an intuitive experience above.

It works like a flow, where User decides on her country and subsequently answers 3 simple questions meant to define a default setting in the eventual investment dashboard.

In the standardized flow that can be tracked for free User immediately in the dashboard gets a full description of the system-build portfolio based on risk aversion. User can go directly to Trade View and see all ETF instruments selected, ISIN codes, costs etc. From there a report can be generated in PDF or sent to E-mail.

But the core simple solution is that User with just a few clicks can build the highest return – lowest risk portfolio available in the financial market.

All solutions are dynamic and recalibrated so in 2 months time, the configuration could be different.